Best Stocks to Buy-Investing in the stock market can seem intimidating, especially if you’re a beginner with limited funds. But with the right information, you can make smart choices and grow your wealth. In this guide, we’ll highlight some of the best stocks for beginners with little money and explain why they could be great choices.

Why Stock Investing is Important for Beginners?

Investing in the stock market helps you grow your wealth over time and provides the potential for higher returns compared to savings accounts. As a beginner, it’s crucial to focus on stocks that offer stability and growth potential. With little money, there are still many ways to start investing wisely.

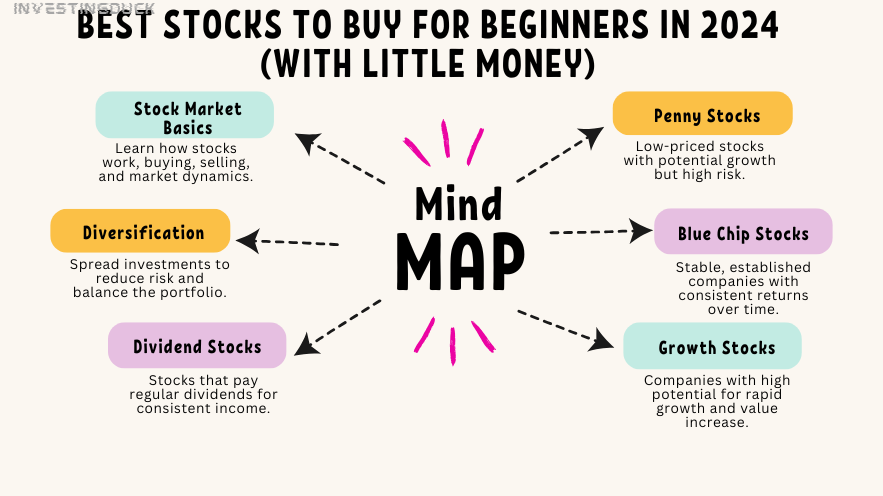

Types of Stocks for Beginners

- Blue-Chip Stocks

- These are well-established companies with stable performance.

- Low risk, steady growth, and dividends.

- Good for beginners looking for reliability.

- Dividend Stocks

- Companies that pay regular dividends to shareholders.

- Provide income while growing your investment.

- Ideal for beginners with limited funds.

- Growth Stocks

- Companies expected to grow at a faster rate than others.

- Higher risk, but offers the potential for bigger returns.

- Suitable for beginners with higher risk tolerance.

- Index Funds & ETFs

- Funds that track a market index (like the S&P 500).

- Instant diversification to reduce risk.

- Perfect for beginners with little money as they require lower investments.

How to Choose the Best Stock for Beginners

Choosing the right stock requires considering several factors:

- Company Stability: Look for companies with solid financials, a history of steady performance, and a clear business model.

- Growth Potential: Consider industries with growth prospects, such as technology, renewable energy, and healthcare.

- Affordability: Choose stocks that align with your budget. Many beginners prefer low-priced stocks, but ensure they have strong growth potential.

- Risk Tolerance: Know your risk tolerance and pick stocks that suit your financial goals and comfort level.

Top 5 Best Stocks for Beginners with Little Money in 2024

Here’s a list of the top stocks that are great for beginners to buy in 2024:

| Stock | Sector/Industry | Price Range | Key Highlights |

|---|---|---|---|

| Apple (AAPL) | Technology/Consumer Electronics | $150+ | Strong brand, consistent growth, reliable dividends. |

| Microsoft (MSFT) | Technology/Software Infrastructure | $300+ | Financially stable, strong market position, low volatility. |

| Vikas Ecotech Ltd | Chemicals/Additives | ₹3-6 | Strong growth in chemicals, over 13% profit growth. |

| Indian Overseas Bank | Banking | ₹60 | 18.5% CAGR over 5 years, solid financials. |

| Reliance Industries | Conglomerate (Energy, Retail) | ₹2000+ | Diversified business, stable growth, and market leader. |

Why These Stocks are Good for Beginners

- Apple (AAPL)

- Apple is a stable company with a strong brand and reliable performance. Its diverse range of products (like iPhones and iPads) ensures steady revenue. Beginners will benefit from its growth and moderate risk.

- Microsoft (MSFT)

- Microsoft is another tech giant with steady growth and solid financials. The company is involved in cloud computing and software, offering strong potential for future growth.

- Vikas Ecotech Ltd

- A low-priced stock with great growth potential. This company specializes in chemicals and polymer compounds, which have been in demand recently.

- Indian Overseas Bank

- This bank has a good history of stable returns and is valued at an affordable price. With consistent growth, it is a good penny stock for beginners.

- Reliance Industries

- Reliance is a diversified conglomerate with ventures in energy, retail, and telecom. It’s a stable investment with huge market influence.

Best Types of Stocks for Beginners with Little Money

For beginners with little money, blue-chip stocks and dividend-paying stocks are often the best choices. They offer stability, potential income, and growth over time.

Additionally, Index Funds and ETFs provide an affordable way to invest in a diverse range of companies, lowering your risk while still giving you exposure to top-performing stocks.

Types of Stocks to Consider

When you’re just starting out with limited capital, it’s important to focus on types of stocks that offer a combination of growth potential and stability. Here’s a breakdown of the main types:

- Blue Chip Stocks:

- These are shares of large, well-established companies with a history of stable performance, such as Apple or Microsoft. They tend to be safer investments but offer lower growth potential.

- Growth Stocks:

- These stocks represent companies expected to grow faster than the overall market. Although they come with higher risk, they can offer higher returns over the long term.

- Dividend Stocks:

- Dividend-paying stocks provide regular income (dividends) to investors. For beginners, these stocks can offer a steady stream of income, making them less volatile and more reliable.

- Index Funds & ETFs:

- These funds track a broad market index, like the S&P 500, giving beginners instant diversification. This approach can lower risk and is an excellent option for those with little capital.

Should You Invest in Penny Stocks?

While penny stocks can be tempting due to their low prices, they come with a higher risk. Many of these companies are smaller or less established, which means their stock prices can fluctuate dramatically. As a beginner, it’s important to be cautious and invest only a small amount in these stocks until you become more experienced.

Benefits of Investing in Penny Stocks

- Low Investment Cost: You can buy a large number of shares with limited capital.

- Growth Potential: Some penny stocks may grow rapidly, offering significant returns.

- Learning Experience: Penny stocks offer an opportunity to learn about market dynamics and company performance.

Disadvantages of Penny Stocks

- High Risk: Penny stocks are volatile and can lead to significant losses.

- Lack of Liquidity: Many penny stocks have low trading volumes, making it hard to buy or sell quickly.

- Limited Information: Smaller companies often provide less financial transparency.

FAQ – Best Stocks to Buy for Beginners in 2024 (with Little Money)

Can I buy stocks with just ₹100?

Yes! Some stocks, especially penny stocks or small-cap companies, have affordable prices, allowing you to start investing with a small amount.

How do I choose the best stock to buy as a beginner?

Look for companies with strong fundamentals, steady growth, and affordable prices. Blue-chip stocks, dividend stocks, and index funds are great for beginners.

Is investing in penny stocks risky for beginners?

Yes, penny stocks can be volatile and have a higher risk of loss. However, they can offer significant returns if chosen carefully. Always research before investing.

Should a beginner invest in stocks?

Yes, but it’s important to start with small investments and choose stocks that align with your risk tolerance and financial goals.

What is the best stock for beginners in 2024?

Stocks like Apple, Microsoft, Vikas Ecotech, and Indian Overseas Bank are great choices for beginners due to their stability and growth potential.

Conclusion

Starting with stock market investing is a smart way to build long-term wealth, even with limited funds. As a beginner, focus on low-cost, stable stocks that offer growth potential, such as blue-chip stocks or diversified ETFs. Always do your research and start with small investments until you become more comfortable with the market dynamics.

Remember, the stock market offers many opportunities, but investing wisely requires patience, knowledge, and a clear strategy.

Disclaimer

The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. The stock market involves substantial risk, and individual investors should conduct their own research or consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results, and no investment strategy is guaranteed to be profitable. The author and publisher are not responsible for any financial losses or damages resulting from the use of this information.